Gambling Vs Investing

Gambling carries much more risk than investing and serves to boost the profits of the casino owner or the player. Investing, on the other hand, arguably provides much more benefit to society. Of course, owners and investors still stand to make profit, but through their actions, local, national and worldwide economies can prosper. Investing in the stock market is not gambling. Equating the stock market to gambling is a myth that is simply not true. Both involve risk and each looks to maximize profit, but investing is not gambling. And, gambling is not investing. Gambling is defined differently than investing. Whether you want to call an investment high risk and you want to say that risk. You know, I don’t like putting money into gold. I think it’s a bad place to put money, but I don’t call it gambling. It’s an ultra-high risk, volatile investment, but it’s not gambling. Gambling and Investing have few things in common. Both these activities involve money and are considered as commercial activities. There are many ways in which to spend one’s money to earn more. 34 Responses to “Gambling vs. Investing: Casinos and the Stock Market” Anonymous April 26, 2016 Some of those excessive couponers possibly end up getting bad.

- Gambling Vs Investing For Dummies

- Gambling Vs Investing Strategy

- Gambling Vs Investing Strategies

- Gambling Vs Investing Websites

For many people, the risk involved in investing can make the whole process feel a bit like gambling. But, truthfully, there is quite a big difference between the two. And that’s exactly why I decided to write this article. In fact, before we get much further, allow me to answer the very important question, is investing gambling?

No, investing is not gambling. While both involve risk, when you invest your money, you receive ownership of something in return. Gambling, on the other hand, is a wager between two parties that depends on a particular outcome and results in a gain for one, and a total loss for the other.

So essentially, the biggest difference between investing and gambling, is that when you invest your money, you are purchasing something of value. Whereas, when you gamble, you only receive some sort of value if you bet on the right outcome.

But that isn’t the only difference.

That’s why, for the rest of this article, I’m going to take a deeper dive into the top 5 reasons why investing is different than gambling.

Let’s get started!

Table of Contents1. Investments Have Value

Gambling Vs Investing For Dummies

As I mentioned at the beginning of this article, whenever you purchase an investment, you receive some kind of ownership in return. For example, when you decide to invest in real estate, you receive ownership of the property you purchase. When you purchase stocks or mutual funds, you receive a portion of ownership in one, or multiple publicly-traded companies. Even when you invest in precious metals (i.e. gold, platinum or silver), which tend to carry a higher-level of risk than many other investments, you receive ownership of the precious metal.

And here’s the thing, in nearly every case, if you invest in something, even if that investment decreases in value, you can still sell it.

That just isn’t the case with gambling.

I mean, if you bet $100 on a particular horse to win the Kentucky Derby, and it doesn’t, you just lost all that money. It’s all or nothing.

Talk about a big difference between investing and gambling.

Posts You Might Also Like:

- How Often Should You Invest? (A Quick Reference Guide)

- Top 10 Reasons To Start Investing Early

- 10 Best Ways To Diversify Your Income

- 10 Reasons Why Passive Income Is So Important

- Can Hard Work Make You Rich? (No, But It’s A Start)

2. Proper Investing Puts The Odds In Your Favor

I don’t think it’s any secret, but when you gamble, especially at a casino, the odds are not in your favor. Unless, of course, you are a casino owner.

You see, the odds in gambling are set to benefit “the house” in the long run. So, mathematically speaking, the longer you gamble the more money you are going to lose.

Meanwhile, as an investor, when you put your money into well-researched, strong investments, the odds of earning a return are in your favor.

For instance, at the time of writing this article, over the last 10 years, the S&P 500 has earned an average annual return of approximately 10% (source). As an investor, I can look at that number and know that it is probably a strong place for me to put my money.

When it comes to gambling, however, those kinds of odds don’t exist over the long-term. Sure, you might win a quick buck here and there, but in the long run, the house always wins.

This is also why people that invest consistently usually end up wealthy, and people that gamble consistently typically end up broke.

3. Compound Interest

As an investor, it is easy to take advantage of the power of compound interest. All you have to do is re-invest your earnings into the same investments that are producing gains, and your money will grow faster and faster. It’s a truly awesome thing to experience.

On the other hand, in order to do the same thing gambling, you would have to win money, and then win more money with the money you already won, and so on. And since the odds are not in your favor, this is an extremely unlikely scenario. And by unlikely, I mean nearly impossible.

4. You Can Diversify Your Investments

If you really want to improve your odds with investing, you have the option of diversifying your investments. For example, you could invest in mutual funds, individual stocks, real estate, and much more.

That way, if one of your investments goes down, and another one goes up, you don’t experience as great of a loss. This is a great way to reduce the likelihood of losing money, and increase your ability to build wealth.

Gambling Vs Investing Strategy

This is not an option when it comes to gambling. Since every gamble carries a high risk of losing money, diversifying your bets would likely only make your odds worse.

5. Humans Play An Important Role In The Outcome Of Investments

The fifth, and my personal favorite, reason why investing and gambling are different, is that humans play a prominent role in the outcome of investments.

For example, when you invest in a company on the stock market, you are putting your money behind executives, employees, and other investors that all have a vested interest in the company earning a profit.

And with all those people working hard to reduce costs, innovate, and grow the company, your likelihood of earning interest on your investment is very good. In other words, humans have the ability to influence the outcome of an investment, which is not the case with gambling.

Truthfully, this isn’t something many people consider when it comes to investing, but it is a critical distinction between investing and gambling. And when you take this critical component into consideration, at least in my experience, investing becomes a much less terrifying venture.

Gambling Vs Investing Strategies

Final Thoughts

Investing and gambling are two very different things. Let’s review:

- With a wise investment strategy, the odds of success are in your favor. Meanwhile, gambling puts the odds against you.

- When you invest in something, you receive ownership in return for your money. Gambling is a high-risk wager, based heavily on chance.

- As an investor, you have the opportunity to earn compound interest. As a gambler, not so much.

- You can diversify your investments in order to lower your risk of losing money. Meanwhile, all forms of gambling come with a high risk of loss.

- Humans play an important role, and can influence the outcome of many investments. Gambling is based on chance.

So there you have it, the 5 key differences between investing and gambling. If you were a little unsure on the subject, I hope this provided you with some clarity. And if you were on the fence about investing, I hope this provided you with a new and positive perspective.

If you found this article helpful, and you’d like to receive similar financial tips, tricks and recommendations, be sure to subscribe to Be The Budget. Our goal here at Be The Budget is to help you save more money, earn a better living, and make the most of your financial life. If that sounds appealing, we’d love to have you join our community!

Gambling Vs Investing Websites

You May Also Like:10 Reasons Why Passive Income Is So Important10 Effective Strategies To Save More Money10 Best Ways To Diversify Your IncomeHow Long Should It Take To Build An Emergency Fund?Zach Buchenau is a self-proclaimed personal finance nerd. When he isn't writing about budgeting, getting out of debt, making extra money, and living a frugal life, you can find him building furniture, fly fishing, or developing websites. He is the co-founder of BeTheBudget, and Chipotle's most loyal customer.Leave a Reply

Subscribe to Be The Budget today, and, as a bonus, we’ll send you a FREE copy of our eBook:Save More Money!

Yes! Send It To Me!

Categories

Budgeting Debt-Free Living Make MoneyGambling Vs Investing – What’s the Difference?

Since the financial crisis of 2008, many consider investing in the stock market a form of gambling. I was among this crowd that developed a negative view of investing. I felt like the stock market was one big online casino and that your money wasn’t safe. At least if you head to a casino to go gambling you’ll get free drinks…

Gambling Vs Investing – Gambling Pros and Cons

One thing that gambling has going for it is that the odds of each game are fixed. You know exactly what you’re getting when you approach a game to play. Most online casinos that have slots, poker, black jack, etc. are all required, by law, to implement the appropriate odds in their games to match their physical counterparts.

Another pro of gambling and online casinos are that they are fun – some times a little too fun 🙂 They can become addictive in a way – much like active day trading in the stock market.

What are the cons of gambling and online casinos? Well, in the long run the game odds are stacked against you. Ever heard the saying that the house always wins? Unless you work to develop some sort of gambling skill (counting cards, card playing systems, etc.) you WILL come out behind in the long run.

Can you make a lot of money gambling? I know a friend’s brother that made ~$75,000+ one year by gambling through an online casino at Texas Hold’em poker (before online gambling and online casinos were outlawed in the US). He also was invited free of charge to a Texas Hold’em 7-day cruise! So yes, you can make money with online casinos IF you know what you’re doing and you have a lot of practice!

Gambling Vs Investing – Investing Pros and Cons

When I talk about investing, I’m mainly discussing investing in public equities through the stock market. What investing has over online casinos and gambling is that over the long run, the market rate of return for the stock market is ~8%. This means that over the long run, if you keep your money invested long enough, you will come out ahead! Another pro of investing vs. gambling is that your dividends and capital gains are taxed as long term capital gains. This means that you’ll pay only 15% taxes. Gambling proceeds are generally taxed as income at a much higher rate. An additional pro that investing has going for it is that if you just decide to invest in market index funds, you’ll find it pretty easy to get started. And, you’ll net yourself some great returns.

Now, what about the cons of investing vs. gambling? Well, investing is pretty boring if done properly. Compared to online casinos and gambling, investing is about the most boring thing in the world – almost like watching grass grow. Also with investing, you may be limited by the liquidity of your investments. This means that if you’re investing in a thinly traded stocks that crashes, you may have a very hard time pulling your money out. Another con of investing is that there is a bit of a learning curve to get started if you decide not to use market index funds. With gambling and online casinos, you can login, click the slots, and be playing for free or with real money in less than a minute – it’s hard to beat that in terms of simplicity!

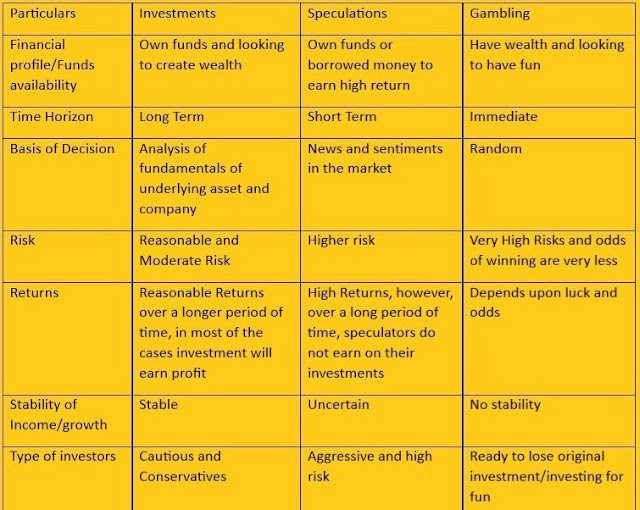

Gambling Vs Investing – Comparison Table

Here’s a simple table that brings a lot of the concepts discussed here together:

Gambling | Investing | |

| Long Term Rate of Return | Depends on skill | + 8% |

| Fun Factor | High | Low |

| Taxes | High | Low |

| Fixed Odds | Yes | No |

| Requires Skill to Come Out Ahead | Yes | Not Really |

Gambling Vs Investing – Final Thoughts

Which is right for you? While gambling with online casinos can be a lot of fun, it really isn’t a strategy that I’d personally recommend to develop your wealth for the long run. Sure, online casinos and gambling are fun, but unless you’re willing to put in a lot of time to develop your gambling skills, you’re very likely to come out behind over the long run 🙂

This post published by Tom Shannon

Coming from Sheffield, Tom’s hobbies include writing, recording music, and creating video games. He also runs events to do with video games where people come to watch tournaments. Tom is currently studying in his final year at university